What Does Feie Calculator Do?

The Best Guide To Feie Calculator

Table of ContentsFeie Calculator Fundamentals ExplainedFeie Calculator Things To Know Before You Get ThisHow Feie Calculator can Save You Time, Stress, and Money.See This Report on Feie CalculatorThe Best Strategy To Use For Feie CalculatorHow Feie Calculator can Save You Time, Stress, and Money.The Of Feie Calculator

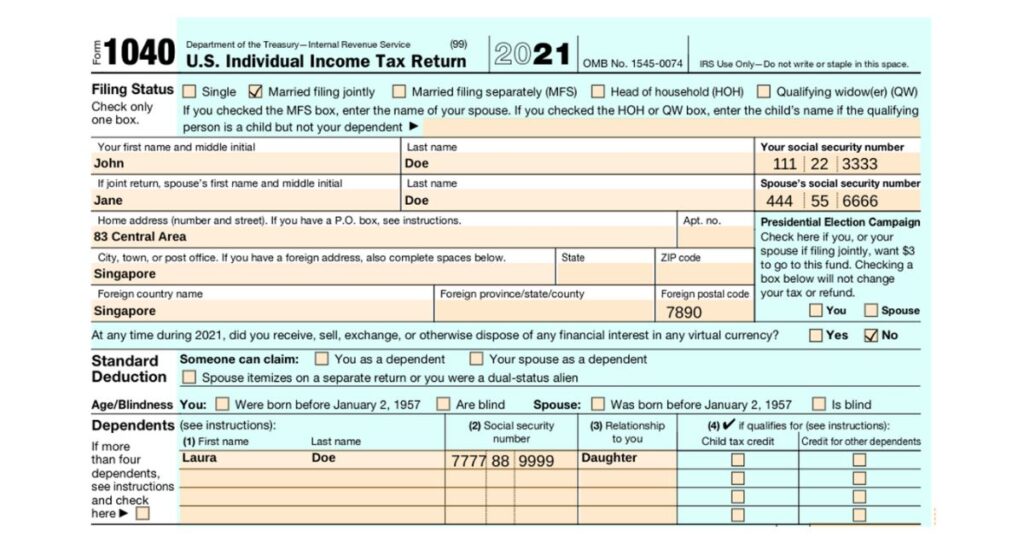

If he 'd regularly taken a trip, he would instead finish Part III, listing the 12-month period he satisfied the Physical Existence Examination and his travel history - Foreign Earned Income Exclusion. Action 3: Reporting Foreign Revenue (Component IV): Mark earned 4,500 each month (54,000 each year). He enters this under "Foreign Earned Revenue." If his employer-provided real estate, its value is additionally consisted of.Mark computes the exchange price (e.g., 1 EUR = 1.10 USD) and converts his salary (54,000 1.10 = $59,400). Given that he resided in Germany all year, the percent of time he lived abroad during the tax obligation is 100% and he goes into $59,400 as his FEIE. Mark reports overall salaries on his Type 1040 and goes into the FEIE as an unfavorable quantity on Arrange 1, Line 8d, lowering his taxed income.

Picking the FEIE when it's not the very best choice: The FEIE may not be suitable if you have a high unearned revenue, earn greater than the exemption restriction, or live in a high-tax country where the Foreign Tax Credit Scores (FTC) might be much more helpful. The Foreign Tax Obligation Credit Score (FTC) is a tax obligation reduction technique usually utilized together with the FEIE.

The smart Trick of Feie Calculator That Nobody is Discussing

deportees to offset their U.S. tax debt with foreign income taxes paid on a dollar-for-dollar decrease basis. This indicates that in high-tax countries, the FTC can frequently eliminate U.S. tax financial obligation completely. However, the FTC has constraints on qualified taxes and the maximum case quantity: Eligible tax obligations: Only income tax obligations (or taxes in lieu of income taxes) paid to foreign governments are eligible.

tax liability on your international revenue. If the foreign taxes you paid exceed this limit, the excess foreign tax obligation can normally be carried ahead for approximately 10 years or lugged back one year (through a modified return). Keeping accurate documents of foreign earnings and tax obligations paid is for that reason vital to determining the right FTC and preserving tax obligation conformity.

expatriates to reduce their tax responsibilities. For example, if a united state taxpayer has $250,000 in foreign-earned revenue, they can omit approximately $130,000 utilizing the FEIE (2025 ). The staying $120,000 might after that go through taxation, yet the united state taxpayer can possibly apply the Foreign Tax obligation Credit rating to balance out the tax obligations paid to the international country.

The smart Trick of Feie Calculator That Nobody is Discussing

He marketed his U.S. home to establish his intent to live abroad permanently and used for a Mexican residency visa with his wife to help meet the Bona Fide Residency Examination. Additionally, Neil secured a lasting home lease in Mexico, with plans to eventually buy a building. "I currently have a six-month lease on a residence in Mexico that I can prolong an additional six months, with the objective to get a home down there." Neil points out that purchasing residential or commercial property abroad can be challenging without first experiencing the area.

"It's something that individuals require to be really persistent concerning," he claims, and suggests expats to be cautious of common errors, such as overstaying in the U.S.

Neil is careful to cautious to Anxiety tax united state that "I'm not conducting any carrying out any kind of Organization. The U.S. is one of the few countries that taxes its residents no matter of where they live, implying that even if a deportee has no income from United state

Get This Report about Feie Calculator

tax return. "The Foreign Tax Credit score permits individuals functioning in high-tax nations like the UK to counter their U.S. tax liability by the quantity they've currently paid in taxes abroad," says Lewis.

The possibility of lower living expenses can be appealing, however it frequently features trade-offs that aren't quickly evident - https://businesslistingplus.com/profile/feie-calculator/. Real estate, as an example, can be much more budget friendly in some countries, but this can suggest compromising on framework, safety and security, or accessibility to reputable energies and services. Low-cost properties may be located in locations with irregular net, minimal mass transit, or undependable health care facilitiesfactors that can substantially impact your daily life

Below are some of one of the most often asked concerns about the FEIE and various other exclusions The International Earned Revenue Exclusion (FEIE) allows united state taxpayers to omit as much as $130,000 of foreign-earned income from government revenue tax obligation, decreasing their united state tax liability. To get approved for FEIE, you need to meet either the Physical Visibility Test (330 days abroad) or the Authentic Home Examination (confirm your primary residence in an international nation for an entire tax obligation year).

The Physical Presence Examination also needs U.S. taxpayers to have both an international earnings and a foreign tax obligation home.

The Buzz on Feie Calculator

A revenue tax obligation treaty in between the U.S. and another nation can help avoid double tax. While the Foreign Earned Revenue Exclusion decreases taxed revenue, a treaty might offer additional benefits for qualified taxpayers abroad. FBAR (Foreign Financial Institution Account Report) is a called for filing for united state citizens with over $10,000 in international financial accounts.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation expert on the Harness platform and the Your Domain Name owner of The Tax obligation Guy. He has more than thirty years of experience and now focuses on CFO solutions, equity payment, copyright taxes, marijuana taxes and separation associated tax/financial preparation issues. He is a deportee based in Mexico.

The international gained income exclusions, often described as the Sec. 911 exclusions, omit tax obligation on salaries gained from working abroad. The exemptions make up 2 components - an income exclusion and a housing exemption. The complying with FAQs discuss the benefit of the exclusions consisting of when both spouses are deportees in a basic manner.

Top Guidelines Of Feie Calculator

The income exemption is currently indexed for rising cost of living. The maximum yearly earnings exemption is $130,000 for 2025. The tax advantage leaves out the income from tax obligation at lower tax rates. Formerly, the exemptions "came off the top" decreasing revenue subject to tax obligation at the top tax prices. The exclusions might or may not lower earnings used for various other purposes, such as individual retirement account limitations, youngster credit ratings, individual exemptions, etc.

These exemptions do not spare the wages from US taxation but merely offer a tax reduction. Note that a bachelor functioning abroad for every one of 2025 that gained concerning $145,000 with no other revenue will certainly have gross income lowered to zero - properly the exact same solution as being "free of tax." The exemptions are calculated on an everyday basis.

If you participated in company meetings or seminars in the United States while living abroad, revenue for those days can not be excluded. Your salaries can be paid in the United States or abroad. Your company's location or the place where earnings are paid are not consider getting approved for the exemptions. Form 2555. No. For US tax obligation it does not matter where you maintain your funds - you are taxed on your globally income as a United States person.